Personal Real Estate Corporations in Ontario

Effective October 1,2020, the Trust in Real Estate Services Act, 2020 (“TRESA”)- Bill 145 was approved and has allowed the formation of Personal Real Estate Corporations (PREC) in Ontario. As of October 1,2020, real estate salespeople and brokers are allowed to incorporate their real estate business in Ontario and can receive their self-employed income to be paid into their PREC. Personal Real Estate Corporations bring many tax benefits for realtors which we will discuss below. However, the decision to form a PREC should be made after careful consideration of an individual realtor’s business, family, financial and personal situation. Before you form a PREC, you should consult with the knowledgeable tax advisors to access and advise on your decision-making process.

WHAT IS A PERSONAL REAL ESTATE CORPORATION?

Personal Real Estate Corporation (PREC) is a professional corporation where the services of a Realtor /Broker are regulated by a governing professional body – Real Estate Council of Ontario (RECO). The articles of incorporation are prepared in compliance with the specific rules and regulations in accordance with RECO. Therefore, before you consider forming a PREC, it is particularly important that you seek the services of a knowledgeable accountant who knows how to set up the corporation as per RECO regulations.

Factors to be considered before deciding to form a PREC

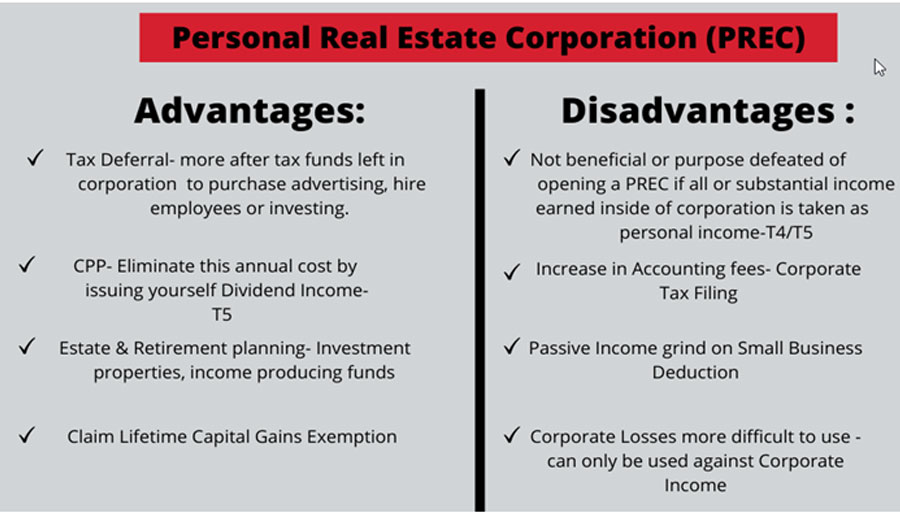

The benefits from the PREC may depend on various factors such as your business and financial situation, tax planning and your current and future goals. Ongoing and proper tax planning advice is required if you form a PREC to reap the benefits of this corporate structure. Please consider the following factors before deciding to forma PREC:

- Are you going to withdraw all or substantial income from the PREC towards meeting your personal living expenses?

- Do you want to plan and save for your retirement?

- Do you want to split business income with your family members who are actively involved in your business activities?

- Are you considering Succession planning i.e., you can pass your business upon retirement to a family member who is a realtor/broker registered with RECO?

- Do you intent to sell your business to a real estate salesperson or broker registered with RECO in future?

- Are you incurring significant business expenses that are either not deductible, such as life insurance premiums, or only partially deductible, such as meal and entertainment expenses?

- Are you looking to grow your business in future i.e., apply tax savings to purchase advertising, hire employees and investing?

- Have you just started your career as a real estate agent/broker or are you established in your professional career?

Please consult a knowledgeable accountant to discuss your financial goals. We, at Bajwa CPA are very proficient in handling all your queries regarding PREC. Please contact us to discuss your situation and for a reliable advice.

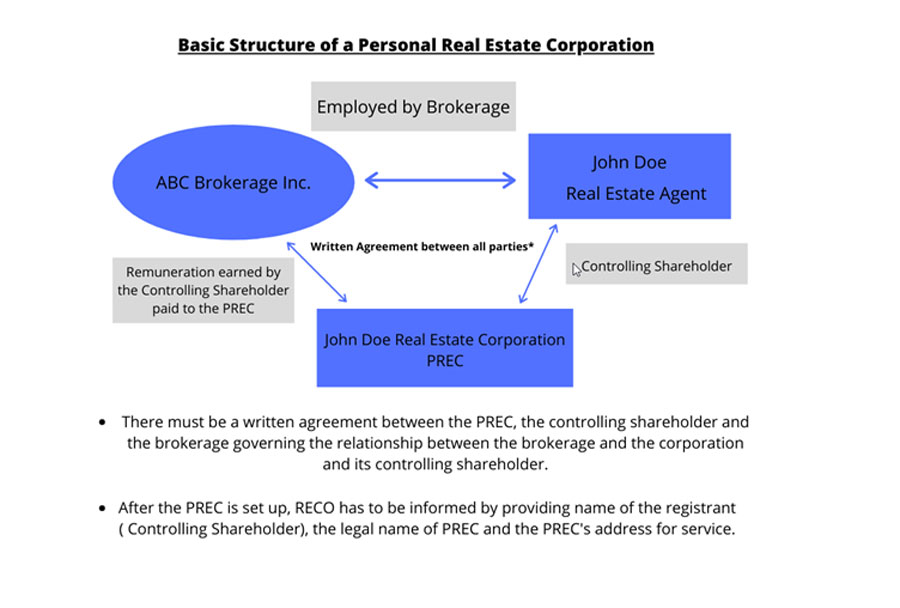

Basic Structure of a PREC

A PREC is a professional corporation which is a separate legal entity from its owner -individual salesperson/broker, who will be a single controlling shareholder – owner of 100% Common voting shares of the PREC. There must be a written agreement between the PREC, the controlling shareholder and the brokerage. The remuneration earned from the real estate services of the controlling shareholder will be paid into the PREC. The PREC is a separate legal entity and will file its own taxes with CRA on its income and expenses from the real estate business. The brokerage will pay the remuneration (including HST) directly to the PREC which is earned by the real estate agent / broker – controlling shareholder of PREC. Only the controlling shareholder is authorized to make decisions for its PREC. Family members who are actively involved in the conduct of the business may become non-voting shareholders of the PREC.

Characteristics of PREC

- PREC is a separate legal entity

- PREC files its own annual tax returns with CRA– Corporate Tax (T2), HST, Payroll

- PREC can own investments – investment properties, shares and mutual funds

- Controlling Shareholder is an employee of the PREC

- PREC allows for Income splitting and tax planning

Advantages & Disadvantages of forming a PREC

At Bajwa CPA, we are proficient in formation of professional incorporations as per requirement and regulations of governing professional bodies. Please contact us at 416-907-0568 to discuss if you have any queries regarding assessment of your tax situation or forming a PREC. We are knowledgeable about the complexities of the Canadian Tax System and provide professional tax services in GTA. We work year-round to minimize your tax burden and provide personalized accounting, taxation, and tax planning services to help you make smart tax decisions. We believe that client success is our success. Bajwa CPA professionally experienced team of Mississauga Tax Services can develop made-to-order tax planning strategies and click a link to learn more about Bajwa CPA tax planning services. Contact us today for any of your tax and accounting needs.

Disclaimer

The information provided in this blog post is intended to provide general information. You should consult with a tax professional to full determine the scope of your situation, Vaishali Bajwa and Bajwa CPA Professional Corporation shall not be held liable from usage of the information provided on this page.

ABOUT THE AUTHOR

Vaishali Bajwa

CPA, CGA

Vaishali Bajwa CPA, CGA is the founder of Bajwa CPA Professional Corporation who has years of extensive professional experience in public practice working with highly satisfied business and individual clients to ensure their taxes are minimized and accounting needs are fulfilled. Bajwa CPA mission is to provide valuable tax planning, accounting, and income tax preparation services in the Greater Toronto Area.